With retirement comes a lot of change, whether it be financially, socially or personally. However we can put plans in place to prepare us for these changes and ease us into this new phase in our lives.

At IPF, We have put together the following services to help you with the planning process and ensure you can reap the benefits of a secure and comfortable retirement.

At IPF, We have put together the following services to help you with the planning process and ensure you can reap the benefits of a secure and comfortable retirement.

1) Retirement GlidepathAs you approach retirement there are several issues that need to be taken into consideration, up to, at and after the event.

This brochure is designed to step you through the retirement process and help you make the decisions that are right for you. Click on the image to the right to download the full brochure. |

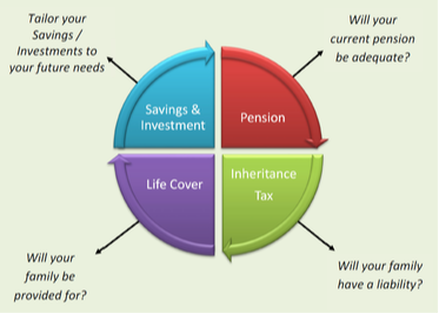

2) Pre-Retirement ConsultationsAfter your retirement, you will have short / medium and long term needs. It is important that you plan as far ahead as possible for each of these stages.

What a pre-retirement consultation will cover:

|

3) Retirement Seminars

Irish Pensions & Finance organise retirement seminars every quarter at various locations around the country. These seminars are free of charge and offer a wide range of speakers.

|

Seminar Agenda:

|

Unfortunately due to Covid restrictions we are not currently able to hold in-person Retirement Seminars, however you can view our recent virtual Retirement Planning webinar here.

4) Retirement HelpdeskAs part of our ongoing service to our retiring / retired clients, we are delighted to introduce the IPF Retirement Help Desk.

Phone number: 01 6910317

Any Public Sector employee can now ring this designated number and have their queries and questions dealt with by a Qualified Financial Advisor with expertise in the Public Sector Superannuation Scheme.

This service is completely free and you can ring as often as you need. |

|

Typical queries we receive into the Helpdesk are:

|